|

|

|

|

|

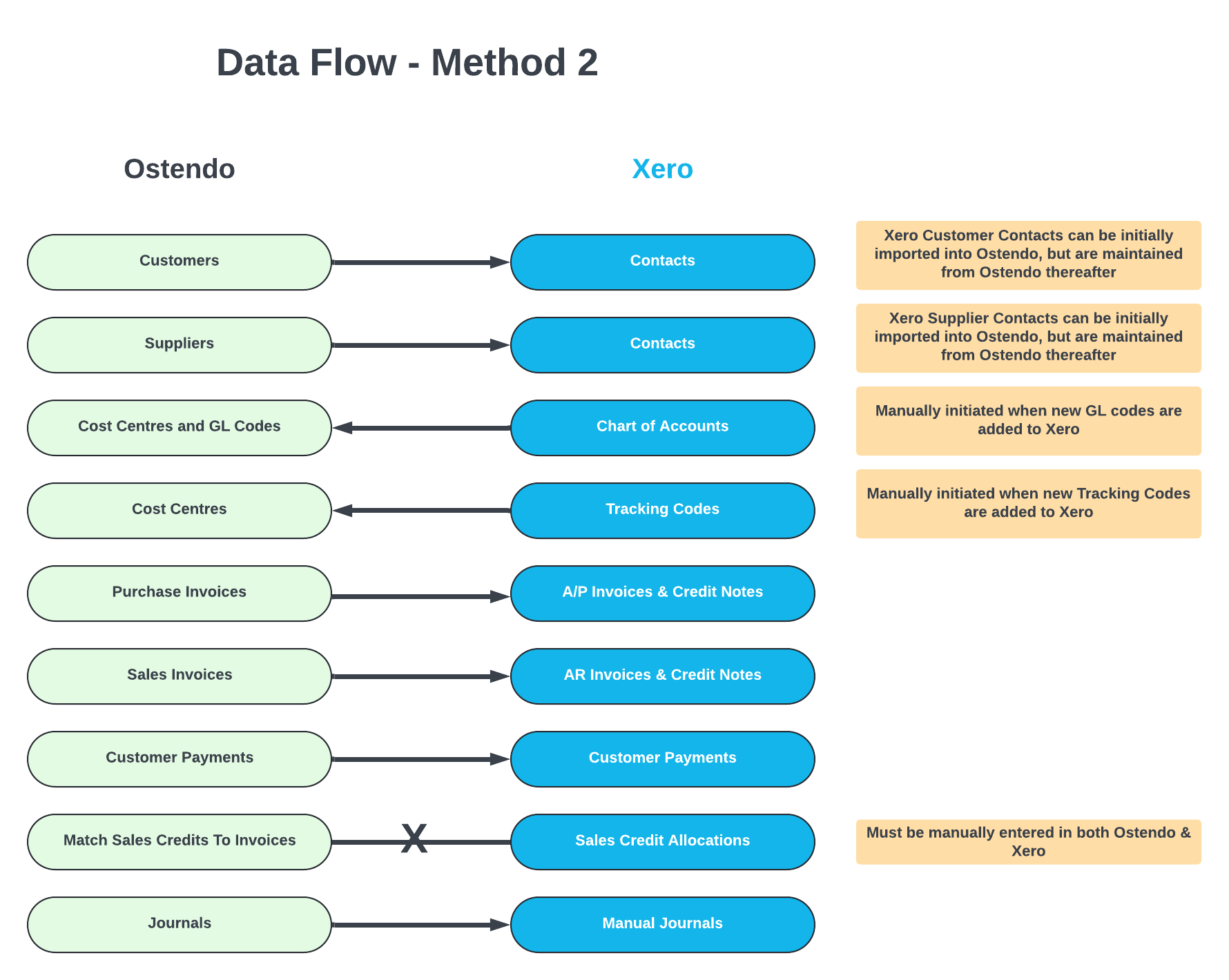

Method 2 Explained

Uses both Xero and Ostendo Accounts Receivable Sub Ledgers

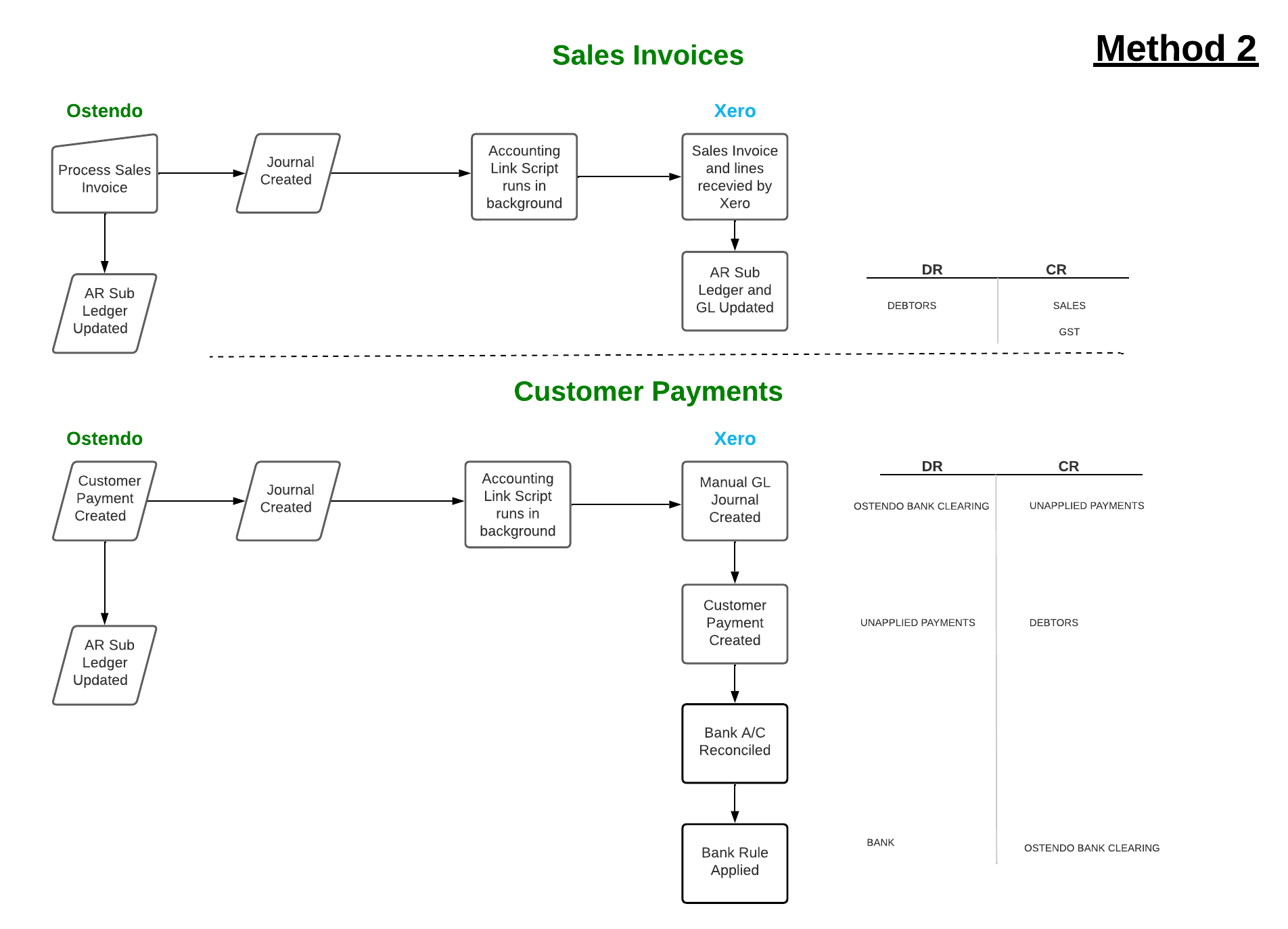

This method allows you to manage AR primarily from Ostendo. The invoice will be raised in Ostendo, then passed through to Xero AR. However unlike Method 1, you would then process the customer payment from within Ostendo. This payment will then be passed through to Xero to update Xero’s AR ledger.

Method 2 MUST be used if ‘ANY’ of these types of transactions originate from within Ostendo

- Point Of Sale

- Customer Payments

- Customer Deposits

This can also be used if an existing Ostendo site prefers to capture customer payments directly within Ostendo even if Ostendo POS or Customer Deposits are not used.

The approach here is that customer payments are primarily maintained within Ostendo and are passed to Xero for Bank reconciliation purposes. Financial Postings are also passed through to Xero in this case.

Customer Statements could be run from either Xero or Ostendo

When you perform a bank reconciliation in Xero, instead of matching the payment to the Sales Invoice, you would be applying a Bank Rule to transfer the amount from a Bank Clearing account (Current Asset) to the Xero Bank account (Bank). This is because Xero does not allow Ostendo to post the Payment directly to the Xero Bank Account, therefore a clearing account is used to post to from Ostendo, leaving Xero to transfer this to Bank clearing at the point of reconciliation.

As customers are added or maintained in Ostendo, those records are passed automatically with the posting process to Xero resulting in either new Contacts added, or existing Contact updated in Xero.

Sales Credit Allocations:

The API does not allow Ostendo receive Sales Credit Allocations to Invoices, therefore these must be manually processed in both systems to keep the AR Ledgers in sync.

Credit Allocation in Xero = Customer Payment Style ‘Match Credits to Invoices in Ostendo.

The process in both systems does not generate any financial entries.

Handling High Sales or Purchase Line Data Volumes:

By default Ostendo will pass all Sales and Purchase Line detail through to Xero as they were entered into Ostendo. Eg: a Sales Invoice may have 20 lines in Ostendo, these 20 lines are passed through to the invoice in Xero.

However, where high sales or purchase line volumes exist Ostendo, we can summarise those lines by Cost Centre Code on the invoice passed to Xero. This means a 50 line invoice in Ostendo may only result in one or two lines being passed through to Xero without influencing the Invoice Total. This strategy can be used for either Sales or Purchase Lines and is defined as an Ostendo User Defined Constant of “Summarise Purchase Invoice Lines” and/or “Summarise Sales Invoice Line”. Click here for more information.