|

|

|

|

|

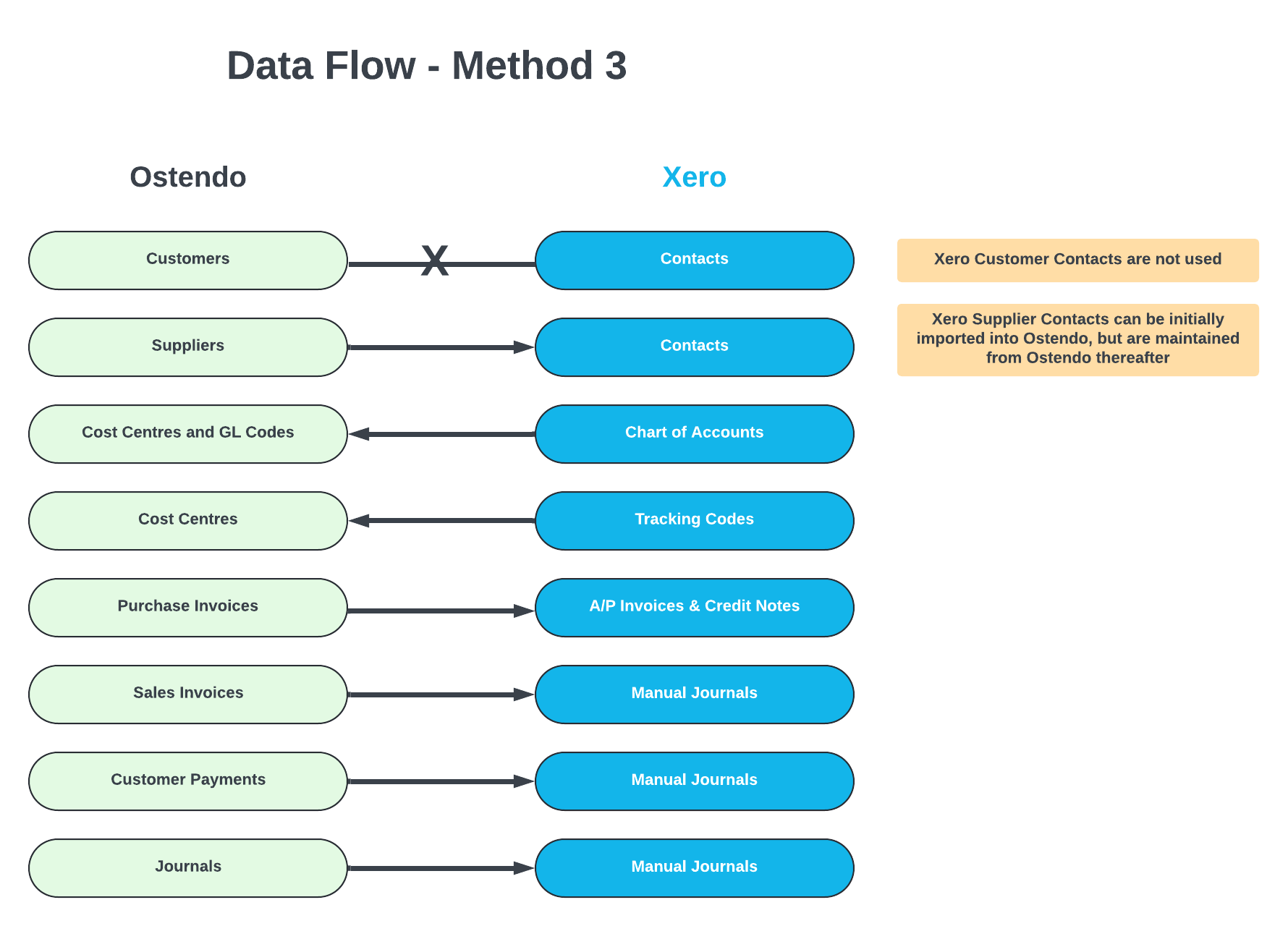

Method 3 Explained

Uses only Ostendo AR Ledger

This method should be used in high volume environments to minimise transaction volumes being passed to Xero. An example of a high volume site would be 500 sales and purchase invoices per day with an average number of lines being 20 or more.

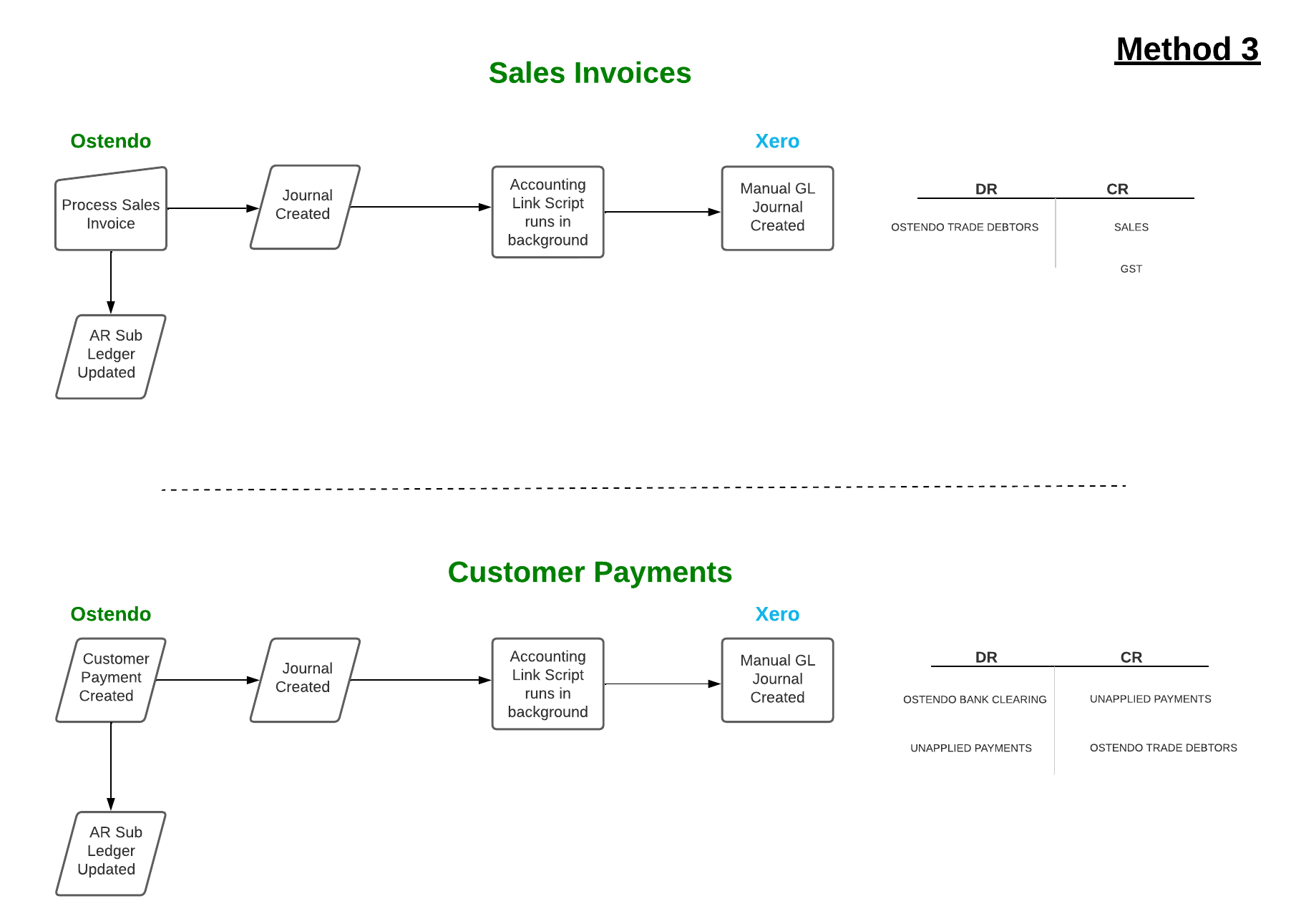

Sales and Payment transactions are posted to Xero in a summarised form and processed daily as one Manual GL Journal. This approach means your debtors ledger is solely controlled from Ostendo. The Xero AR sub ledger and Customer Contacts are not used. Xero will only report the total Debtors value at a Balance Sheet level, whilst Ostendo will provide the detail from its own sub-ledger reporting.

This method adopts the approach that the AR ledger is solely maintained within Ostendo therefore Customer Statements can only be run from Ostendo.

When you perform a bank reconciliation in Xero, instead of matching the payment to the Sales Invoice, you would be applying a previously created Bank Rule to transfer the amount from a Bank Clearing account to the Xero Bank account.