|

|

|

Sage Evolution Live API Setup

To integrate Ostendo with Sage Evolution, you need to do the following:

|

A. |

Activate the Sage Evolution SDK Connector |

|

B. |

Complete the Accounting Link setup in Ostendo |

Existing Invoices

If there are any outstanding invoices in Ostendo which are not fully paid before the planned cutover date, these must be manually created in Sage Evolution with the exact same invoice numbers otherwise subsequent payments (entered after cutover) will not be posted.

The following information is required to establish the connection with the Sage Evolution database:

|

- |

The password for Username sa. |

|

- |

The Common Connection Server name |

|

- |

The Common Database name |

|

- |

The Company File (SQL) Server name |

|

- |

The Company file (database) name |

Also required is an SQL Provider to make SQL calls to the Sage Evolution database.

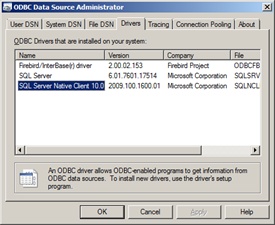

Go to Control Panel à Administrative Tools à Data Sources (ODBC).

Go to the Drivers tab and you should see something like this:

|

- |

The SQL Provider in this example would be SQL Server Native Client 10.0. |

Evolution Inventory Defaults

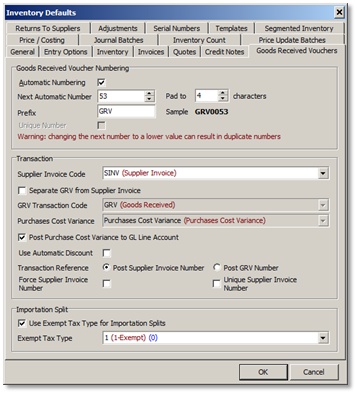

Go to Inventory Maintenance – Inventory Defaults and click on Goods Received Vouchers tab.

|

- |

Untick Separate GRV from Supplier Invoice |

-Select Post Supplier Invoice Number for Transaction Reference

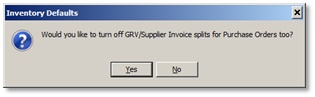

-Then click YES for Purchase orders too.

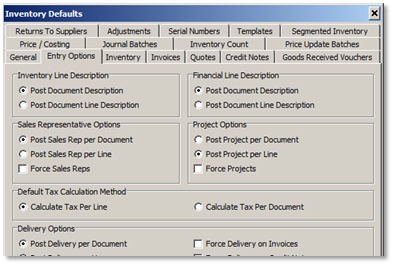

If you are using Project Codes, go to the Entry Options tab and turn on Post Project per Line.

-Decimal Positions: Under the General tab, set the Decimal Places as shown. This is to avoid any rounding differences between Ostendo and Evolution.

Transaction Types

Please make sure the appropriate posting accounts are specified in all Transaction Types in Inventory, Accounts Receivable, and Accounts Payable.

For example: Inventory | Maintenance | Transactions Types.

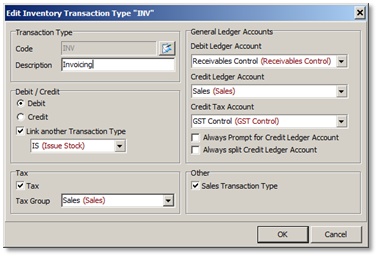

INV – this transaction type is used for Sales Invoice posting. Set the Debit account to Trade Debtors, Credit account to Sales, and the Tax account to the GST account for Sales. Tick the option for Tax. See below:

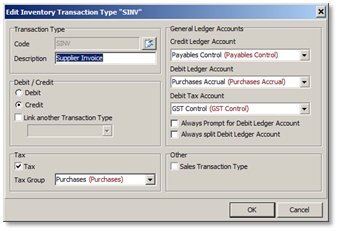

SINV – This transaction type is used for Purchase invoice posting. Set the Credit account as Trade Creditors, the Debit account as the Purchase Accrual / Purchase Receipt not Invoiced, and specify the Tax account. Tick the Tax option. See below:

Revenue Accounts

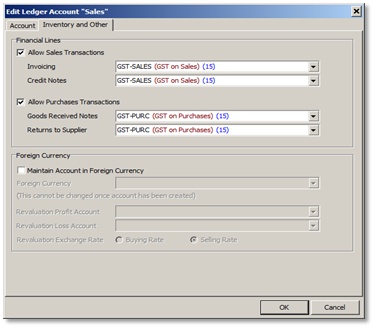

Make sure your revenue accounts are set up to allow sales and purchase transactions. For example:

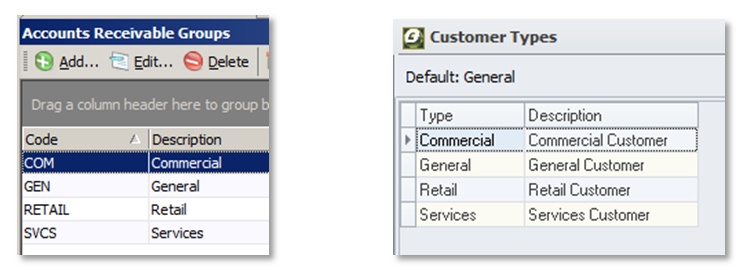

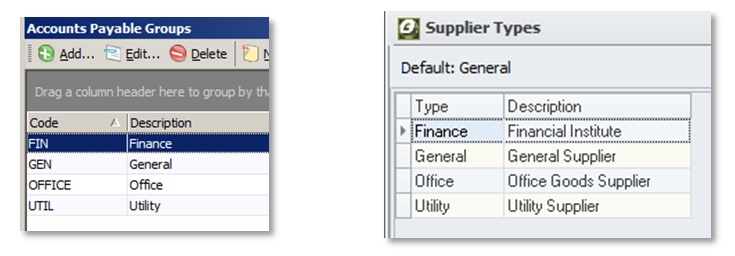

Accounts Receivable Groups and Accounts Payable Groups

– make sure the Descriptions matches CustomerTypes and SupplierTypes in Ostendo respectively.

Accounts Receivable and Accounts Payable Areas

– make sure the Descriptions matches the RegionCodes used for Ostendo Customers and Suppliers.

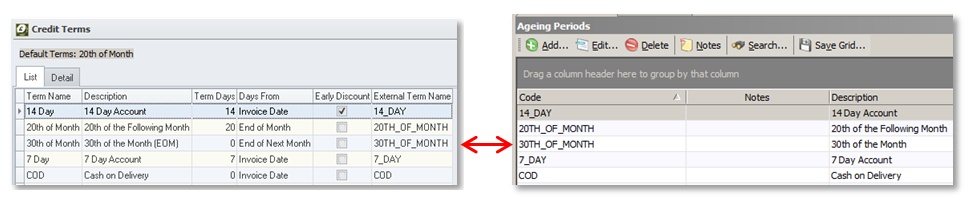

Accounts Receivable and Accounts Payable Ageing Periods

The ExternalCreditTerm in CreditTerms table in Ostendo must match the Code in the AR or AP Ageing Periods in Evolution. If no match is found, default terms will be used.

Please note that Ageing Periods in Evolution are set in both Accounts Receivable and Accounts Payable whereas there is only one Credit Terms table in Ostendo for both Customers and Suppliers.