|

|

|

|

|

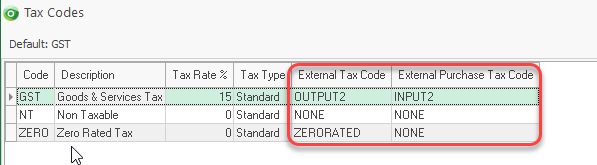

Tax Codes

File -> Financial Configuration -> Tax Codes

- Ensure you have linked the appropriate External Tax Codes to the Ostendo Tax Codes.

NB: The setup below is typical for NZ, however for Australia and other regions, different External Tax Codes are used.

Please refer to http://developer.xero.com/documentation/api/types/#TaxTypes

In Ostendo, ensure the Tax Codes / Groups and Matrix rules have been specified.

Setup an appropriate Ostendo Tax Code with the Tax Rate %. Enter the appropriate Xero External Tax Code (Income) along with the External Purchase Tax Code (NB: These are case sensitive)

This means that one Ostendo Tax Code can be set for both Sales and Purchases whilst Xero’s individual External Tax Codes will be used when the transactions are posted.

Xero relies on specific Tax Types in order to determine Input / Output Tax. You must specify these from the base country of your Xero database.

Eg:

New Zealand

|

TAX TYPE |

RATE |

NAME |

SYSTEM DEFINED |

|

INPUT2 |

15.00 |

GST on Expenses |

|

|

NONE |

0.00 |

No GST |

Yes |

|

ZERORATED |

0.00 |

Zero Rated |

|

|

OUTPUT2 |

15.00 |

GST on Income |

|

|

GSTONIMPORTS |

0.00 |

GST on Imports |

Yes |

Australia

|

TAX TYPE |

RATE |

NAME |

SYSTEM DEFINED |

|

OUTPUT |

10.00 |

GST on Income |

|

|

INPUT |

10.00 |

GST on Expenses |

|

|

EXEMPTEXPENSES |

0.00 |

GST Free Expenses |

Yes |

|

EXEMPTOUTPUT |

0.00 |

GST Free Income |

|

|

BASEXCLUDED |

0.00 |

BAS Excluded |

|

|

GSTONIMPORTS |

0.00 |

GST on Imports |

Yes |

New Zealand: INPUT2 (15% GST on Exps)

OUTPUT2 (15% GST on Income)

ZERORATED (Zero Rated on Income NB: Ensure the Ostendo External Purchase Tax Code is set to NONE)

Australia OUTPUT (10% GST on Exps)

INPUT (10% GST on Income)

ZERORATED (Zero Rated on Income NB: Ensure the Ostendo External Purchase Tax Code is set to NONE)